This is a follow up to my earlier post - Elavasam's Third Law of Accounting. If you have not read that, this would be a good time to do that.

There was a question from a friend, after he read that post. "All I have is a bank account, What is this rent account you are talking about or the phone account. I dont have those accounts. I don't get what you are trying to say."

In answering his question, I am going to peel yet another layer of the accounting onion here.

I asked him if he had a habit of noting down his expenses. He said yes. It was a diary his financial transactions. Another name for a diary is a journal and in accounting, a list of transactions is called a journal. See the image below, to see an accounting journal.

It has the date, the particulars of the transactions and the amount is entered either in the debit column or in the credit column depending on whether you are spending it or receiving it. This is nothing but a record of all the transactions made. This could be a done on a piece of paper, in a notebook or using an app.

If I asked my friend what is the total amount of rent he has paid this year, he would need to go through all the entries in his journal and sum up the amounts for the rent paid to get the total. That is not a very efficient way to get information.

If he had a notebook and used one page in that notebook for each type of expenditure it would be easy to track. ‘How much did you spend on account of rent?’, could easily answered by looking at that page in the notebook. Hence that page is called the account.

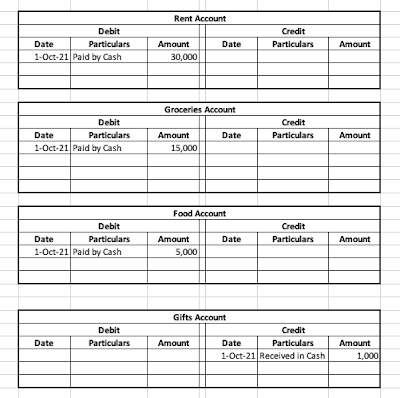

In a typical accounting process the transactions are first written in a journal and are then posted to the accounts. Let us take an example. On a particular day, let us assume, my friend had a cash balance of Rs. 100,000. During the day he paid rent of Rs. 30,000. He also bought groceries for Rs. 15,000 and ate out for Rs 5,000. He also received Rs. 1,000 as gift.

His accounting journal for the day would look like

Based on the journal above, we can see that he needs to track his cash, and have a page each for gifts received, rent, groceries and eating out. The choice of how many accounts need to be opened is his. He can choose to have all expenses under one account or he could have rent in one account and have groceries and food together in one account. For a corporate, however, there are rules that govern how these transactions need to be accounted and so they need to comply with those rules.

The entries from the journal would be posted in these accounts. Since each account can either have a debit or credit, they are typically represented in the form of a T, with the debit entries posted on the left and the credit entries on the right. His cash account would look like this.

You can see that the account starts with a balance on the debit side. This is in line with the rule that says all assets have a debit balance. Cash on hand, is an asset to us and hence starts with a debit balance. The entries posted are to signify if cash is coming in or going out and are respectively debited and credited in this account. His expenses for rent, groceries and eating out would be accounted in the following manner and his income, in the form of gifts received, would look like this.

Just a glance of these accounts would tell you what the total of transactions under that account is. You will also note that for every debit there is a corresponding credit. This is the basis of what is called as the double entry bookkeeping. You can create as many such accounts as it is required to record the transactions. These days, the accounting apps have a screen for input of the transaction and the updating of the journal and the accounts are automatically taken care of.

Thus accounting is done in two steps, the first is to record all the transactions in an accounting journal and the second is to post these entries to the relevant accounts so that obtaining the totals and balances becomes an efficient process.

From these accounts you can draw up the profit and loss statement and the balance sheet, but that is for another day.

0 comments:

Post a Comment